Business Brokers of California

Having the most experienced team of business brokers in California, our team has sold hundreds of small to medium-size businesses in the past 25 years. Let us help you get the best value for your years of hard work! You deserve to enjoy the future you have earned!

We encourage you to visit the many informative areas of this website. Don’t hesitate to call us today.

Selling a business is one of the most important events in any Entrepreneur’s life. Zoom Business Brokers have one of the most experienced local team of business brokers who can help you overcome so many obstacles along the way of this highly complex process.

In the era of ZOOM calls, we still believe in the power of face-to-face meetings in critical moments. That’s why our local brokers make sure they are close enough to be able to meet when there is a need. We are thrilled that we have drunk so many glasses of champagne with business owners who were celebrating their successful sales in the past 25 years.

If you are looking for a business broker in California, make sure to talk to us about your business.

After decades of doing this, we have a proven 9 step process to sell your business:

Preparing to sell your business by maximizing its efficiency, earning potential, structure and presentation really pays off. For example, minimizing costs and increasing annual profit by as little as $5,000 could add $20,000 to the sale price. We can help you recast your profit and loss (P&L) to determine your true SDE (Seller’s discretionary earnings).

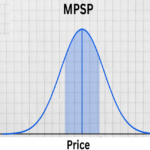

Naturally you want the maximum price for your business. But setting and asking price too high could scare away potential buyers. While pricing too low means less financial reward for your hard work, there are many ways to value a business. Using a combination of these will usually provide the most realistic price band. The methodology must be accurate and appropriate for your type of business and stand up to expert scrutiny. Every business is unique, making it vital to deal with people who have proven experience in establishing true market value.

An Information memorandum (IM) is a comprehensive document that gives a detailed overview of the business. It must be crafted to ensure it is accurate and represents your business honestly, while adhering to numerous legal requirements and regulations. This includes disclosing anything that may harm the ongoing profitability.

It takes more than setting the right price to find your ideal buyer. Having access to a large database of qualified buyers in your sector means greater competition and a better sale price. As independent professionals, ZBB brokers can discreetly approach buyers we believe might be interested, without divulging information.

Zoom Business Brokers has one of the most experienced group of business brokers in Southern California. Through decades of experience and measurement of our experienced brokers we know how to create effective marketing campaigns. Ads, brochures, web, social media and other communications are carefully planned and executed to attract buyers without identifying your business.

We know that not every inquiry about a business for sale is from a genuine potential buyer. But screening every buyer is often a surprisingly time consuming and difficult process. Actin as an independent third party, ZBB brokers can maintain confidentiality until all potential buyers have been checked for buying capacity – education, experience and finance.

After a potential buyer has reviewed the information Memorandum and expressed interest, they’ll have more questions and will usually ask for further information or documents. A ZBB broker co-ordinates this process, by liaising with the business owner or their financial/legal terms to negotiate a conditional Purchase Agreement without yet supplying sensitive details.

Signing the Purchase Agreement doesn’t necessarily mean the business is sold. Most buyers will want to verify your information during a due diligence period. They’ll also need to review information previously witheheko due to commercial sensitivity. This process generally takes 5 to 5 working days, although for more complex businesses, it can be up to 90 days or more.

Once all the agreement conditions have been satisfied, the Conditions Removals ar signed, and escrow will be opened. Escrow is a means, time period and trust arrangement during which the paperwork required for the sale of a business is processed. Escrow acts as a “neutral” agent of seller, buyer and broker to collect documents, money and to distribute the same according to escrow instructions as directed by the principals.

Do you want to learn more about our process?

Subscribe and receive our 18 page brochure with all those steps explained even more

Subscribe to our list to get up-to-date information about our Listings

Business Brokers California

California comprises 58 counties. These counties included Alameda, Alpine, Amador, Butte, Calaveras, Colusa, Contra Costa, Del Norte, El Dorado, Fresno, Glenn, Humboldt, Imperial, Inyo, Kern, Kings, Lake, Lassen, Los Angeles, Madera, Marin, Mariposa, Mendocino, Merced, Modoc, Mono, Monterey, Napa, Nevada, Orange, Placer, Plumas, Riverside, Sacramento, San Benito, San Bernardino, San Diego, San Francisco, San Joaquin, San Mateo, Santa Barbara, Santa Clara, Santa Cruz, San Luis Obispo, Shasta, Sierra, Siskiyou, Solano, Sonoma, Stanislaus, Sutter, Tehama, Trinity, Tulare, Tuolumne, Ventura, Yolo, and Yuba Counties.

Knowledge of the local area has always been helpful for the performance of Business Brokers in California.

How the 2024 U.S. Elections Affect the Business Buy and Sell Market

The U.S. election cycle is always a time of great change and uncertainty for the economy,...

Maximizing Success in Selling Your Business: The Essential Guide to Engaging CPAs, Lawyers, and Business Brokers

Selling a business is a complex and multifaceted process that involves various steps, from...

Navigating the Waters of Equity Investment: Understanding the Potential for an Equity Firm to Acquire Your Business

In the dynamic world of business, the prospect of an equity firm acquiring a small or...

Selling Your Business: Beyond the Bottom Line – Why It Might Be Time to Let Go

As a business broker, I often face a common question from owners after valuing their...

Selling Your 50% Share vs. Selling the Whole Business: A Comparative Analysis

In the world of entrepreneurship, there comes a point when an owner might consider exiting a...

The Hidden Risks of Selling Your Business Without a Broker

When it comes to selling a business, owners often contemplate whether to hire a business...

How to Determine the Most Probable Selling Price (MPSP) for Your Business

Every business owner who has contemplated selling their establishment has faced the...

Why You Should Address Your Company’s Weaknesses Head On

By spotting your company’s weaknesses you can take steps to remedy them and improve operations,...

Getting the Most out of a Partnership Agreement

As an entrepreneur and business owner, your partnership agreement stands as one of the most...

Why Exit Planning is Crucial for Business Owners: Secure Your Future with Strategic Planning

As a business owner, you've undoubtedly poured your heart and soul into building your...

The Critical Importance of Confidentiality When Selling a Business

When preparing to sell any business, maintaining strict confidentiality throughout the sales...

Looking to Get a Loan Without a Personal Guarantee? Here’s What You Need to Know

When it comes to financing a business acquisition, one of the most common questions buyers...

4 Questions to Ask Yourself Before Buying a Business

When in the process of buying a business, some buyers have accidentally overlooked important...

Navigating the Unexpected in the Business Sales Process

Each business sale is a unique journey filled with a myriad of experiences. The...

Decoding the Market Pulse Report: Key Insights

The Market Pulse Report is a comprehensive resource that provides valuable...

The Allure of Business Ownership: Exploring the Benefits and Risks

Have you ever considered owning a business? For many, the allure of becoming their own boss...

Navigating the Business Climate: Four Key Insights from the Recent BizBuySell Quarterly Review

BizBuySell serves as an invaluable hub for both business buyers and sellers, providing an...

Decoding the Concept of a Fairness Opinion

In the world of mergers, acquisitions, and business transactions, the term "fairness...

Buying a Business with Minimal Collateral: Your Guide to Making it Happen

Taking the leap to become a business owner is exciting, but it can also be daunting,...

The Essential Queries: 4 Questions to Consider Before Purchasing a Business

Investing in a business requires more than just a keen interest and available capital; it...

Key Findings from the Recent BizBuySell Insight Report: A Brief Analysis

Whether you're considering buying or selling a business, it's beneficial to examine the...

Is Your Business Transaction Truly Complete?

When you're at a point in your business transaction where a letter of intent is duly signed,...

Strategizing for Successful Deal Negotiation: Key Questions to Consider

Almost every transaction involving a business's sale entails significant negotiations...