The Hidden Risks of Selling Your Business Without a Broker

When it comes to selling a business, owners often contemplate whether to hire a business broker or handle the sale themselves. Many buyers prefer direct negotiations with owners, sometimes even sidestepping the market to make unsolicited offers. While the allure of a quick sale and avoiding commission fees might seem tempting, there are several pitfalls to be aware of. Here’s why you should contact a business broker the minute you receive a direct inquiry from a potential buyer.

- Leveraging Multiple Offers

- Raising the Stakes: When a business is listed on the market—especially a profitable one—there are often multiple buyers interested. This competition can drive up the price, putting you, the owner, in a better negotiating position.

- Strategic Negotiation: A broker can manage multiple offers in such a way as to stimulate a bidding war, which could significantly increase your final sale price.

- Safeguarding Confidential Information

- Screening Buyers: A broker will typically vet potential buyers to ensure they are serious and financially capable before disclosing any sensitive information.

- Non-Disclosure Agreements: A broker can require potential buyers to sign NDAs, thus adding a layer of security and protecting your proprietary information.

- Streamlining the Sale Process

- Time Management: Deals can drag on if not properly managed, which can lead to buyer fatigue and lower offers. A broker helps guide the process, setting deadlines for offers, due diligence, and other steps to keep things on track.

- Preventing Time Wasters: By keeping strict timelines and requirements, a broker can discourage buyers who are not serious or who intend to stall the process.

- Optimizing Net Profit

- Expertise: While you might save on a broker’s fee, that doesn’t mean you’ll make more money in the end. Brokers have specialized skills in business valuation, negotiation, and deal structure that could ultimately net you a higher sale price.

- Risk Mitigation: A sale is a complex process fraught with legal and financial risks. A single mistake could cost you far more than a broker’s fee.

- Emotional Detachment

- Objective Evaluation: Owners often have an emotional attachment to their business, which can cloud judgment during negotiations. A broker offers an objective third-party perspective, which can be invaluable.

- Buffer Zone: Having a broker also provides a psychological buffer between you and the buyer, making it easier to navigate contentious issues without harming the business relationship.

- Legal Compliance and Paperwork

- Documentation: Business brokers are familiar with the legal requirements for selling a business, ensuring that all contracts, disclosures, and other documents are correctly prepared and filed.

- Closing the Deal: A broker will facilitate the closing process, ensuring a smooth transition and minimizing the chance of last-minute hiccups that could derail the sale.

Conclusion: Selling your business is not just a financial decision; it’s an emotional one too. It’s easy to overlook the complexities involved when you’re navigating the process alone. Engaging a professional business broker can offer multiple layers of protection, ultimately ensuring that you exit your business with your financial and emotional well-being intact.

Schedule your call to talk to our representative about the sale of your business here: https://zoombusinessbrokers.com/schedule-a-call/

Article is written by: Sara Vaziri, MBA, MSc, CBB, CBI

© 2023 Zoom Business Brokers

How to Determine the Most Probable Selling Price (MPSP) for Your Business

Every business owner who has contemplated selling their establishment has faced the question, “What’s the best selling price for my business?” The answer is more complex than simply pulling a figure from thin air. It’s a blend of analyzing data, understanding market trends, and assessing the unique value proposition of your business. Enter the concept of the Most Probable Selling Price (MPSP).

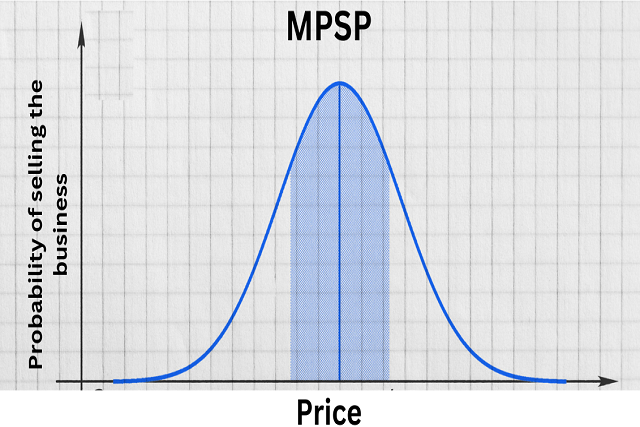

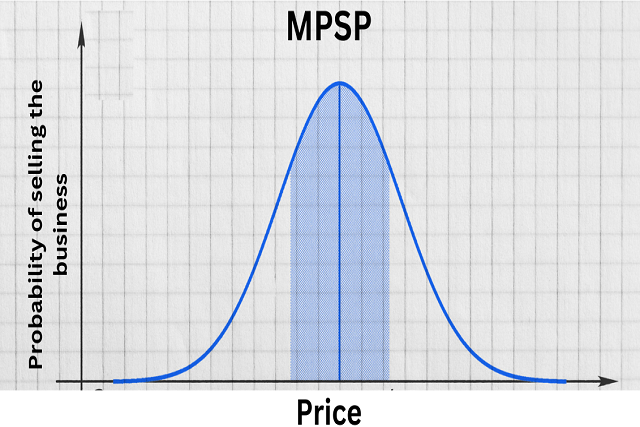

Understanding the Bell-Shaped Curve in Business Sales

Imagine a bell-shaped curve graph. On the horizontal axis, you have the selling price of a business. On the vertical axis, the probability of the business selling at that price. At the peak of the curve is the MPSP, where the probability of selling is highest.

This means that while you might be able to sell your business for a price much higher than the MPSP, the chances of finding a buyer willing to pay that premium are slim. Think of it like a balance scale; as the price increases, the likelihood of a sale decreases.

The Risks of Overpricing Your Business

It’s tempting to list your business at a price higher than its MPSP in hopes of landing that ‘dream buyer’. However, there are inherent risks with this approach. A business that remains on the market for an extended period starts to raise eyebrows. Potential buyers might think, “If it’s such a great deal, why hasn’t anyone snapped it up yet?” This perception can lead to a vicious cycle where the longer your business remains unsold, the harder it becomes to find a buyer, even at the MPSP.

Furthermore, an overpriced business can deter genuine buyers right off the bat. They might bypass your listing in favor of more reasonably priced options, assuming that negotiations would be futile.

The Importance of Flexibility in Pricing

Setting the right selling price is more of an art than an exact science. Start by pricing your business slightly above the MPSP. This allows room for negotiation and shows potential buyers that you value your business.

However, remain attuned to the market’s feedback. If there’s little interest or if potential buyers consistently feel the price is too high, be ready to adjust. Remember, the ultimate goal is to sell your business, and sometimes a minor price adjustment can reinvigorate interest.

In Conclusion

When deciding on the selling price of your business, it’s essential to trust the expertise of your business broker. They possess the experience and knowledge to determine an accurate MPSP. Avoid pushing for an inflated price based on emotional attachment or unfounded expectations. Instead, focus on achieving a fair market value that reflects your business’s worth and facilitates a timely sale.

By being realistic and responsive to market feedback, you enhance your chances of selling your business efficiently and profitably. Remember, the right buyer at the right price is out there. It’s all about striking the perfect balance.

Would you like to know what the MPSP of your business is? Schedule a time to talk to our representative here: https://zoombusinessbrokers.com/schedule-a-call/

Article is written by: Sara Vaziri, MBA, MSc, CBB, CBI

© 2023 Zoom Business Brokers

Essential Steps to Take Before Buying a Business: A Comprehensive Guide

Purchasing a business is an exciting yet daunting process, especially if you are a first-time buyer. The journey from identifying a potential business to closing the deal involves a myriad of details, each critical to ensuring a successful transition of ownership. As you embark on this path, it is crucial to approach the process with thoroughness and diligence to safeguard your investment and future success.

In this article, we will explore the essential steps you should take before buying a business. These steps will guide you through the complexities of the process, helping you make informed decisions that align with your goals.

1. Conduct Thorough Market Research

Before diving into the specifics of a potential business acquisition, it’s essential to understand the market in which the business operates. This involves analyzing industry trends, competition, customer demographics, and market demand. Market research will provide you with valuable insights into the viability of the business and its growth potential.

Key Considerations:

- Industry Trends: Investigate whether the industry is growing, stable, or declining. Understanding where the industry is headed will help you anticipate future opportunities and challenges.

- Competitive Analysis: Identify the business’s direct competitors and assess their market position. What makes the business you’re considering unique? Does it have a competitive edge?

- Customer Demographics: Analyze the target market for the business. Who are the customers, and what are their purchasing behaviors? Understanding the customer base is crucial for planning future marketing strategies.

- Market Demand: Assess the demand for the business’s products or services. Is there a growing demand, or is the market saturated?

By conducting thorough market research, you’ll be better equipped to evaluate the potential of the business and make an informed decision.

2. Review Legal Documents

Legal due diligence is one of the most critical steps in the business acquisition process. Before moving forward with a purchase, you must review all relevant legal documents to ensure that the business is compliant with laws and regulations. This step will also help you identify any legal liabilities that could impact your decision.

Key Documents to Review:

- Business Licenses and Permits: Ensure that the business has all the necessary licenses and permits to operate legally. Verify that these are up to date and transferable.

- Contracts and Agreements: Review contracts with suppliers, customers, employees, and any other third parties. Pay attention to any clauses that could affect the business post-acquisition, such as non-compete agreements or termination clauses.

- Trademarks and Intellectual Property: Verify the ownership and validity of any trademarks, copyrights, patents, or other intellectual property. This step is crucial to protecting the brand and its assets.

- Litigation History: Investigate any past or ongoing litigation involving the business. Legal disputes can be costly and time-consuming, so it’s important to understand the potential risks.

Working with a legal professional who specializes in business transactions can help you navigate this complex process and ensure that you don’t overlook any critical details.

3. Examine Financial Records

A detailed examination of the business’s financial records is essential to understanding its financial health and viability. This step will help you assess the business’s profitability, cash flow, and overall financial stability.

Key Financial Documents to Review:

- Income Statements: Analyze the income statements to understand the business’s revenue, expenses, and profitability over the past few years. Look for trends in sales and expenses that could indicate the business’s financial trajectory.

- Balance Sheets: Review the balance sheets to assess the business’s assets, liabilities, and equity. This will give you a snapshot of the company’s financial position at a given point in time.

- Cash Flow Statements: Evaluate the cash flow statements to understand how cash flows in and out of the business. Positive cash flow is critical for maintaining operations and funding future growth.

- Tax Returns: Review the business’s tax returns for the past three to five years. This will help you verify the accuracy of the financial statements and identify any potential tax liabilities.

- Accounts Receivable and Payable: Examine the accounts receivable and payable to assess the business’s working capital and credit policies. Look for any red flags, such as overdue accounts or a high level of debt.

It’s advisable to work with an accountant or financial advisor who can help you interpret these financial documents and provide insights into the business’s financial health.

4. Understand the Business’s Operational Structure

Understanding how the business operates on a day-to-day basis is crucial to ensuring a smooth transition of ownership. This involves analyzing the business’s operational structure, including its processes, systems, and employee roles.

Key Operational Areas to Assess:

- Management Structure: Evaluate the current management structure and determine whether key managers or employees are likely to stay on after the acquisition. Their knowledge and expertise can be invaluable during the transition.

- Standard Operating Procedures (SOPs): Review the business’s SOPs to understand how tasks are performed and ensure that there are documented processes in place. SOPs are essential for maintaining consistency and efficiency.

- Technology and Systems: Assess the technology and systems used by the business, such as accounting software, inventory management systems, and customer relationship management (CRM) tools. Determine whether these systems are up to date and scalable.

- Supply Chain and Inventory: Examine the business’s supply chain and inventory management practices. Identify any potential issues, such as reliance on a single supplier or excess inventory, that could impact operations.

By gaining a deep understanding of the business’s operational structure, you’ll be better prepared to manage the business effectively and implement any necessary changes.

5. Evaluate the Business’s Reputation and Customer Relationships

A business’s reputation and customer relationships are invaluable assets that can significantly impact its success. Before purchasing a business, it’s important to assess how the business is perceived in the market and the strength of its customer relationships.

Key Areas to Evaluate:

- Online Reviews and Ratings: Check online reviews and ratings on platforms like Google, Yelp, and industry-specific review sites. Positive reviews can indicate strong customer satisfaction, while negative reviews may highlight areas for improvement.

- Customer Loyalty: Analyze customer loyalty by reviewing metrics such as repeat business, customer retention rates, and customer lifetime value (CLV). Loyal customers are a sign of a healthy business with a strong value proposition.

- Brand Reputation: Assess the overall reputation of the brand in the market. This includes evaluating its positioning, brand equity, and any recent marketing campaigns.

- Customer Feedback: If possible, speak directly with customers to gather feedback on their experiences with the business. This can provide valuable insights into customer satisfaction and areas where the business excels or needs improvement.

A strong reputation and loyal customer base are critical to the long-term success of the business. Ensuring that these assets are in place will help you build on the business’s existing strengths.

6. Assess the Business’s Growth Potential

When purchasing a business, it’s important to consider not only its current performance but also its potential for future growth. This involves identifying opportunities for expansion, innovation, and increased profitability.

Key Growth Opportunities to Explore:

- Market Expansion: Consider whether there are opportunities to expand the business into new markets or geographic regions. This could involve opening new locations, targeting different customer segments, or expanding online sales.

- Product or Service Diversification: Evaluate the potential to diversify the business’s product or service offerings. Introducing new products or services can help attract new customers and increase revenue streams.

- Operational Efficiency: Identify areas where operational efficiency can be improved, such as streamlining processes, reducing costs, or implementing new technologies. Increased efficiency can lead to higher profit margins and a competitive advantage.

- Marketing and Sales Strategies: Assess the effectiveness of the business’s current marketing and sales strategies. Consider whether there are opportunities to enhance these efforts through digital marketing, social media, or other channels.

By identifying and planning for growth opportunities, you’ll be better positioned to maximize the value of your investment and achieve long-term success.

7. Understand the Seller’s Motivations

Understanding why the current owner is selling the business is an important part of the due diligence process. The seller’s motivations can provide valuable context and help you identify any potential red flags.

Common Reasons for Selling a Business:

- Retirement: Many business owners sell their businesses as they approach retirement. In this case, the sale may be driven by personal reasons rather than any issues with the business itself.

- Health Issues: Health concerns can prompt a business owner to sell. While this may not indicate any problems with the business, it’s important to understand the circumstances and whether the owner’s departure could impact operations.

- Burnout: Business owners may experience burnout after years of running a business, leading them to seek a sale. It’s important to assess whether the business has become stagnant or if there are opportunities to revitalize it.

- New Opportunities: Some owners sell their businesses to pursue new opportunities or ventures. This could indicate that the business is in good health and has potential for continued success.

By understanding the seller’s motivations, you’ll gain insight into the current state of the business and whether there are any underlying issues that could impact your decision to buy.

8. Negotiate the Purchase Agreement

Once you’ve completed your due diligence and decided to move forward with the purchase, the next step is to negotiate the purchase agreement. This is a critical step that will define the terms and conditions of the sale, including the purchase price, payment structure, and any contingencies.

Key Elements of the Purchase Agreement:

- Purchase Price: Negotiate a fair purchase price based on the business’s financial performance, assets, and market conditions. Consider hiring a business valuation expert to help determine the appropriate value.

- Payment Structure: Discuss the payment structure, including any upfront payments, financing arrangements, or earn-outs. An earn-out can be a useful tool to bridge gaps in valuation expectations between the buyer and seller.

- Contingencies: Include contingencies in the purchase agreement that protect you as the buyer. Common contingencies include securing financing, satisfactory completion of due diligence, and obtaining necessary approvals.

- Non-Compete Agreement: Negotiate a non-compete agreement to prevent the seller from starting a competing business after the sale. This is important for protecting your investment and market position.

- Transition Plan: Discuss a transition plan with the seller to ensure a smooth handover of the business. This may include a period of training and support from the seller to help you get up to speed.

Working with an experienced business attorney is essential during this phase to ensure that the purchase agreement is fair and legally sound.

9. Secure Financing

Securing financing is often a necessary step in the business acquisition process, especially for larger transactions. There are several financing options available, each with its own advantages and considerations.

Common Financing Options:

- Traditional Bank Loans: Traditional bank loans are a common option for financing a business purchase. These loans typically offer competitive interest rates, but they may require a substantial down payment and strong credit history.

- SBA Loans: Small Business Administration (SBA) loans are a popular choice for business acquisitions, particularly for smaller businesses. SBA loans offer favorable terms and lower down payments, but the application process can be lengthy.

- Seller Financing: In some cases, the seller may be willing to finance a portion of the purchase price. This can be an attractive option as it often involves more flexible terms and may indicate the seller’s confidence in the business.

- Private Investors: Private investors or venture capitalists may provide financing in exchange for equity or a share of future profits. This option can provide additional capital, but it may involve giving up some control over the business.

It’s important to carefully evaluate your financing options and choose the one that best fits your needs and financial situation.

10. Plan for Post-Acquisition Integration

Successfully integrating the business after the acquisition is critical to achieving your goals and maximizing the value of your investment. This involves developing a comprehensive integration plan that addresses key areas of the business.

Key Areas to Focus On:

- Cultural Integration: Assess the company culture and identify any potential challenges in merging the existing culture with your own management style. A smooth cultural integration is essential for maintaining employee morale and productivity.

- Communication: Develop a clear communication plan to keep employees, customers, and other stakeholders informed throughout the transition. Transparency is key to building trust and minimizing uncertainty.

- Operational Integration: Identify any operational changes that need to be made, such as updating processes, implementing new systems, or restructuring teams. A well-thought-out operational plan will help ensure a seamless transition.

- Customer Retention: Focus on retaining existing customers by maintaining the quality of products or services and addressing any concerns they may have about the change in ownership. Customer retention is critical to maintaining revenue and building loyalty.

- Growth Initiatives: Develop and implement growth initiatives that align with your vision for the business. This may include expanding the product line, entering new markets, or launching new marketing campaigns.

By planning for post-acquisition integration, you’ll be better prepared to take the business to the next level and achieve long-term success.

Conclusion

Buying a business is a complex process that requires careful planning, thorough due diligence, and strategic decision-making. By following the steps outlined in this guide, you’ll be well-equipped to navigate the challenges of business acquisition and make informed choices that align with your goals.

Remember, the key to a successful business purchase is to approach the process with diligence and patience. Take the time to conduct thorough research, seek professional advice, and carefully evaluate all aspects of the business before making a decision. With the right preparation and mindset, you can successfully acquire a business that meets your needs and sets the stage for future growth and success.

Article written by Sara Vaziri, MBA, MSc, CBB, CBI

Read More

Why You Should Address Your Company’s Weaknesses Head On

By spotting your company’s weaknesses you can take steps to remedy them and improve operations, however, this is only the beginning of the benefits derived from spotting these types of issues. You should be the world’s foremost expert on your company and the investment that it represents. Identifying and repairing any negative issues will pay dividends both today and potentially for the life of your company.

There are many areas of weakness that companies may experience. In this article, we’ll look at a few of the key areas that many share

Workforce Issues

An area of business weakness that is receiving a good deal of well-deserved attention in recent years are problems related to the workforce. Workforce headaches are varying between industries and sectors. It has been well documented that young people are not entering trades in the numbers needed to replace retiring workers. This is a fact that is causing significant headaches for many businesses. An aging workforce will impact some businesses more significantly than others. Understanding the labor situation as it pertains to your business is a critical move for any business owner.

Overreliance

Being overly reliant on any one supplier, customer, product line or even employee or group of employees, may have an impact on your business in a number of ways. Supply chain interruptions, disruption to income and cash flows, labor shortages and a diminishment in the perceived value of your business by future buyers are just a few of the issues you may encounter. Diversification isn’t just a smart way to handle one’s portfolio, but is also a smart way to address your business plan. If your business is overly reliant in any one area, it is a good idea to measure the risk vs. reward and seek out ways to diversify if necessary. Your business will be stronger and worth more in the end.

General Industry Decline

Nothing lasts forever. Once upon a time, the country’s landscape was littered with Blockbuster Videos, but today Blockbuster Video has joined the vast and great technological dinosaurs of the past.

There is no escaping the fact that industries change. Being on the tail end of that change without a transition plan to meet new and potentially more profitable opportunities is not a good place to be. One of your key jobs as a business owner is to identify issues and problems within your industry and adapt, ideally ahead of the competition. Part of this adaptation may ultimately include knowing when it is time to exit your business entirely.

Business brokers and M&A advisors specialize in helping business owners spot weaknesses and then strategize to make significant improvements. The world of business is changing and evolving faster than ever before. Engaging with experienced advisors who can help you navigate this flurry of ongoing change could spell the difference between success and failure; while greatly improving the value of your business, rewarding you handsomely in your retirement.

Copyright: Business Brokerage Press, Inc.

The post Why You Should Address Your Company’s Weaknesses Head On appeared first on Deal Studio – Automate, accelerate and elevate your deal making.

Getting the Most out of a Partnership Agreement

As an entrepreneur and business owner, your partnership agreement stands as one of the most important business documents you will sign. Business structures can be as complicated as the people that create those businesses. Quite often, business owners create businesses with friends or loved ones and, as a result, will not have a proper partnership agreement in place.

It’s important to note that not having a partnership agreement in place is a mistake. There are too many unknowns and too many variables not to have this essential document. You need a legal framework to protect your business from the vast array of potential pitfalls that may have an impact.

The Key Elements of a Solid Partnership Agreement

At the top of the list of every partnership agreement is a clear outline and understanding of rights and responsibilities. All too often partnerships run into trouble as the rights and responsibilities of the parties aren’t clearly thought through and then outlined in a partnership agreement.

Mapping out rights and responsibilities will help eliminate problems in the future. A partnership agreement should be seen as a serious legal document. As such, it is prudent to work with an experienced lawyer in the area of partnership agreements.

What Every Partnership Agreement Should Address

At the top of the list, every partnership agreement should address how money is to be distributed and which partner(s) will receive a draw. The issue of who will contribute funds so that the business becomes operational should be very plainly spelled out in the partnership agreement. A failure to address this issue could end the business before it even gets off the ground.

Issues such as what percentage each partner will receive and who will be in charge are two additional key areas that should never be overlooked. In terms of issues that are frequently overlooked by those forming a partnership, it is common for those forming a partnership to overlook long-term issues such as what is to happen in the event of the death of a partner, what steps are to be taken to bring in a new partner, and how business decisions are made.

Without a solid partnership agreement in place, business owners may find themselves in the last place they want to be, namely, court. A lengthy court battle can weaken your business in a very wide range of ways including a hit to company morale as well as the loss of key customers and employees. A legal battle between business partners can destroy what would otherwise be a healthy and thriving business.

The time you invest in the creation of a business agreement is time and money well spent. In fact, it is safe to state that a business agreement might just turn out to be one of the greatest investments you ever make.

Copyright: Business Brokerage Press, Inc.

Jirapong Manustrong/BigStock.com

The post Getting the Most out of a Partnership Agreement appeared first on Deal Studio – Automate, accelerate and elevate your deal making.