How the 2024 U.S. Elections Affect the Business Buy and Sell Market

The U.S. election cycle is always a time of great change and uncertainty for the economy, and the 2024 election is no different. As candidates outline their policies and economic plans, business owners, investors, and buyers are closely monitoring the potential impact of election outcomes on their decisions to buy or sell businesses. In the run-up to the 2024 elections, numerous factors are...Read More

Maximizing Success in Selling Your Business: The Essential Guide to Engaging CPAs, Lawyers, and Business Brokers

Selling a business is a complex and multifaceted process that involves various steps, from valuation to negotiation and finally, the transfer of ownership. It’s a decision that carries significant financial and legal implications for the business owner. Given the complexity of the process, many business owners find themselves pondering whether they need to enlist the help of...Read More

Navigating the Waters of Equity Investment: Understanding the Potential for an Equity Firm to Acquire Your Business

In the dynamic world of business, the prospect of an equity firm acquiring a small or medium-sized enterprise (SME) is not just a possibility; it’s a significant event that could redefine the future of the business. Understanding what drives these acquisitions and how to position your business as an attractive target can be the key to unlocking new growth and opportunities....Read More

Selling Your Business: Beyond the Bottom Line – Why It Might Be Time to Let Go

As a business broker, I often face a common question from owners after valuing their businesses: “Why should I sell if I can just work a few more years and earn that amount?” It’s a straightforward concern. In this article, I’ll explain why selling your business could be a wise choice, looking beyond just the income to consider the bigger picture for your life and your...Read More

Selling Your 50% Share vs. Selling the Whole Business: A Comparative Analysis

In the world of entrepreneurship, there comes a point when an owner might consider exiting a venture. The reasons vary: perhaps it’s to cash in on years of hard work, maybe there’s a lucrative offer on the table, or it could be due to personal circumstances. Whatever the case, one crucial decision lies ahead—should you sell your 50% share or collaborate with your partners to sell...Read More

The Hidden Risks of Selling Your Business Without a Broker

When it comes to selling a business, owners often contemplate whether to hire a business broker or handle the sale themselves. Many buyers prefer direct negotiations with owners, sometimes even sidestepping the market to make unsolicited offers. While the allure of a quick sale and avoiding commission fees might seem tempting, there are several pitfalls to be aware of. Here’s why you...Read More

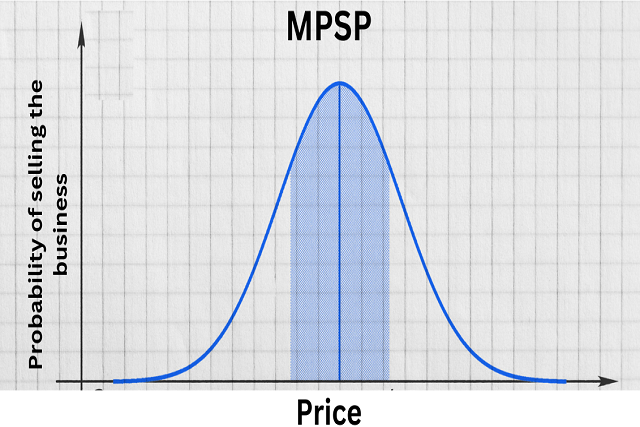

How to Determine the Most Probable Selling Price (MPSP) for Your Business

Every business owner who has contemplated selling their establishment has faced the question, “What’s the best selling price for my business?” The answer is more complex than simply pulling a figure from thin air. It’s a blend of analyzing data, understanding market trends, and assessing the unique value proposition of your business. Enter the concept of the Most...Read More

Essential Steps to Take Before Buying a Business: A Comprehensive Guide

Purchasing a business is an exciting yet daunting process, especially if you are a first-time buyer. The journey from identifying a potential business to closing the deal involves a myriad of details, each critical to ensuring a successful transition of ownership. As you embark on this path, it is crucial to approach...Read More

Why You Should Address Your Company’s Weaknesses Head On

By spotting your company’s weaknesses you can take steps to remedy them and improve operations, however, this is only the beginning of the benefits derived from spotting these types of issues. You should be the world’s foremost expert on your company and the investment that it represents. Identifying and repairing any negative issues will pay dividends both today and potentially for the life...Read More